Quiz

following behavior

of banks would be an example of regulatory arbitrage?

(A). Banks increase their exposure to corporate debt.

(B). Banks decrease their exposure to corporate debt.

(C). Banks shift their exposure to more risky corporate debt.

(D). Banks shift their exposure to less risky corporate debt.

Explanation:

Quiz

(A). Regulatory capital is determined by rules imposed by an outside authority, such as a

supervisor or

central bank.

(B). Regulatory capital is the lowest level of economic capital the bank should have to meet

regulatory

requirement.

(C). Regulatory capital reflects the economic tradeoffs of the bank as accurately as the bank

can represent

them.

(D). Regulatory capital is less than the regulatory capital requirement.

Explanation:

Quiz

(A). Fixed notional amount per contract

(B). Fixed dates for delivery

(C). Traded Over-the-counter only

(D). Daily margin calls

Explanation:

Quiz

the elements of

the operational risk framework depend on:

?I: The culture of the financial institution

II. Regulatory drivers

III. Business drivers

IV. The bank's reporting currency

(A). I, IV

(B). II, III

(C). II, IV

(D). I, II, III

II. Regulatory drivers

III. Business drivers

IV. The bank's reporting currency

(A). I, IV

(B). II, III

(C). II, IV

(D). I, II, III

Quiz

EXCEPT:

(A). Loss data collection

(B). Risk and control self-assessment

(C). Compliance document preparation

(D). Scenario analysis

Explanation:

Quiz

have been all of

the following EXCEPT:

?I: Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

(A). I

(B). II

(C). I, II

(D). III, IV

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

(A). I

(B). II

(C). I, II

(D). III, IV

Quiz

portfolio. Which of the

following measures the sensitivity of duration to interest rates?

(A). Modified duration.

(B). Yield curve

(C). Convexity.

(D). Credit spread.

Explanation:

Quiz

(RAROC) is correct?

RAROC is the ratio of:

(A). Risk to the profitability of a trading portfolio or a business unit within the bank.

(B). Value-at-risk to the profitability of a trading portfolio or a business unit.

(C). Profitability to the expected return of a trading portfolio or bank business unit.

(D). Profitability to the risk of a trading portfolio or bank business unit.

Explanation:

Quiz

(A). The owner of these options decides if the option is a call or put option only when a

predetermined date

is reached.

(B). These options represent a variation of the plain vanilla option where the underlying asset

is a basket of

currencies.

(C). These options pay an amount equal to the power of the value of the underlying asset

above the strike

price.

(D). These options give the holder the right to exchange one asset for another.

Explanation:

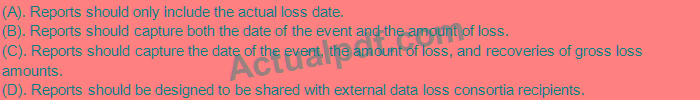

Quiz

with a large

branch network. Which minimal data standards should this collection approach include to

meet minimum loss

data collecting standards?

Explanation:

Financial Risk and Regulation (FRR) Series Practice test unlocks all online simulator questions

Thank you for choosing the free version of the Financial Risk and Regulation (FRR) Series practice test! Further deepen your knowledge on GARP Simulator; by unlocking the full version of our Financial Risk and Regulation (FRR) Series Simulator you will be able to take tests with over 345 constantly updated questions and easily pass your exam. 98% of people pass the exam in the first attempt after preparing with our 345 questions.

BUY NOWWhat to expect from our Financial Risk and Regulation (FRR) Series practice tests and how to prepare for any exam?

The Financial Risk and Regulation (FRR) Series Simulator Practice Tests are part of the GARP Database and are the best way to prepare for any Financial Risk and Regulation (FRR) Series exam. The Financial Risk and Regulation (FRR) Series practice tests consist of 345 questions and are written by experts to help you and prepare you to pass the exam on the first attempt. The Financial Risk and Regulation (FRR) Series database includes questions from previous and other exams, which means you will be able to practice simulating past and future questions. Preparation with Financial Risk and Regulation (FRR) Series Simulator will also give you an idea of the time it will take to complete each section of the Financial Risk and Regulation (FRR) Series practice test . It is important to note that the Financial Risk and Regulation (FRR) Series Simulator does not replace the classic Financial Risk and Regulation (FRR) Series study guides; however, the Simulator provides valuable insights into what to expect and how much work needs to be done to prepare for the Financial Risk and Regulation (FRR) Series exam.

BUY NOWFinancial Risk and Regulation (FRR) Series Practice test therefore represents an excellent tool to prepare for the actual exam together with our GARP practice test . Our Financial Risk and Regulation (FRR) Series Simulator will help you assess your level of preparation and understand your strengths and weaknesses. Below you can read all the quizzes you will find in our Financial Risk and Regulation (FRR) Series Simulator and how our unique Financial Risk and Regulation (FRR) Series Database made up of real questions:

Info quiz:

- Quiz name:Financial Risk and Regulation (FRR) Series

- Total number of questions:345

- Number of questions for the test:50

- Pass score:80%

You can prepare for the Financial Risk and Regulation (FRR) Series exams with our mobile app. It is very easy to use and even works offline in case of network failure, with all the functions you need to study and practice with our Financial Risk and Regulation (FRR) Series Simulator.

Use our Mobile App, available for both Android and iOS devices, with our Financial Risk and Regulation (FRR) Series Simulator . You can use it anywhere and always remember that our mobile app is free and available on all stores.

Our Mobile App contains all Financial Risk and Regulation (FRR) Series practice tests which consist of 345 questions and also provide study material to pass the final Financial Risk and Regulation (FRR) Series exam with guaranteed success. Our Financial Risk and Regulation (FRR) Series database contain hundreds of questions and GARP Tests related to Financial Risk and Regulation (FRR) Series Exam. This way you can practice anywhere you want, even offline without the internet.

BUY NOW